13th December, 2021 Mellor launches new all-electric Sigma range 'zero-emissions, zero compromise’ · Mellor unveils first two Sigma models at COVID-19-restricted press previews at Millbrook · Sigma marks a ‘redefinition’ of zero-emissions public transport vehicles · Six distinct models: 7 and 10-metre variants signal start of phased introduction · Orders being taken immediately with all variants to benefit from European Type Approval · “After significant investment, and benefitting from our vastly experienced engineers and our partner component manufacturers, we’re bringing our new Sigma range to market, and the beginning of a new chapter in the history of Mellor in the UK,” Mellor’s Bus Division Managing Director Mark Clissett Mellor presented its new Sigma range of battery electric, ‘zero-emissions zero-compromise’ buses at a special, COVID-19-restricted press preview event last week at the UTAC Proving Ground in Millbrook. In a major repositioning of the Mellor business, the Rochdale-based bus manufacturer believes its new product range offers a redefinition of zero-emissions public transport vehicles, launched as global attitudes toward a more sustainable future drives demand for cleaner solutions to public transport. The new Mellor Sigma range comprises six models with overall lengths from 7 to 12-metres, 30 to 80 passenger capacities, ‘city’ and ‘rural’ specifications, plus width and passenger door configurations to further broaden the range to over 20 individual variants. The result is one of the largest ranges of low-floor Battery Electric Vehicle (BEV) buses from any manufacturer in Europe. Initial 7 and 10-metre models are available to order today. Key to Sigma’s operational appeal is its lightweight construction, thus allowing for smaller battery capacities to reduce energy consumption. In partnership with industry-leading component manufacturers – among them CATL, Webasto, ZF, Dana and Ventura – Sigma will be fully EU Type Approved. Plus, with a three-year bumper-to-bumper warranty, 8-year battery warranty and 15-year structural warranty, Sigma presents a whole-life package that delivers an impressively low total cost of ownership. Mellor Sigma: bold move reflects global attitudes In the most significant repositioning of Mellor’s commercial activities in its recent history, the new zero-emissions Sigma range comes to market as nations around the world focus on a cleaner, more environmentally protective future; where public concerns over vehicle CO2 emissions see pressure exerted on governments and local authorities to provide funding for bus operators. The move is a bold statement of intent from Mellor as it further enhances its presence with UK bus fleet operators. With one of the widest ranges of model variants and specifications on the market, Mellor believes its ongoing mandate to produce size- and cost-appropriate vehicles means Sigma’s unrivalled choice will – for the first time – provide customers with a zero-emissions, zero-compromise transport solution from a single manufacturer. Six Sigma models in phased introduction The Sigma range also places Mellor firmly in the midi-bus sector serving BEV markets in the UK and overseas. Initial 7 and 10-metre Sigma models are available to order immediately, with customers placing orders today expected to take delivery of their vehicles by early summer 2022. A further four models, including 8, 9, 11 and 12-metre variants, will be phased-in during 2022, with customer deliveries also expected within the same period. Sigma also boasts an extensive choice of widths, operating ranges and gross vehicle weights, allowing the company to offer a truly no-compromise vehicle specification and allowing Mellor to enter previously untapped markets. “After significant investment, and benefiting from our vastly experienced engineers and our partner component manufacturers, we’re bringing our new Sigma range to market, and the beginning of a new chapter in the history of Mellor in the UK,” said Mellor’s Bus Division Managing Director Mark Clissett. “We’re naturally frustrated that the ongoing public health concerns in the UK meant we were unable to give Sigma the fanfare-launch it deserves, but reaction from selected customer previews has been overwhelming, and we’re very confident that Sigma is really going to shake-up the UK bus market at its full launch and ride-and-drive event early in the New Year. We truly believe Sigma represents a redefinition of the zero-emissions bus offering,” he said, “with exacting model options available to deliver the lowest possible total cost of ownership across the widest range of city and rural operations.” “Sigma not only marks a turning point for Mellor,” he added, “it is also the most important product introduction of its kind from any bus builder in the last decade.” ENDS Notes to editors: - Rochdale-based Mellor is a leading manufacturer of size-appropriate buses to suit a wide range of operations, with a 27,000sq.ft. manufacturing facility comprising state-of-the-art production equipment and processes - Boasting a 60-year history, Mellor is well established as a key vehicle manufacturer in the North-West - Plans for new 54,000sq.ft Mellor (Scarborough) facility scheduled for completion in 2022 - Three production lines, 500-vehicle per year capacity, 130-strong skilled workforce - Sigma is the model designation for Mellor’s new range of BEV midi-buses, from 7 to 12-metres and 8 to 19-tonnes GVW - Further product range includes Strata, Orion, Maxima and Tucana - Low-floor, zero-emissions electric and accessible model variants with a wide range of seating options - Mellor is part of the Woodall Nicholson group of companies - Woodall Nicholson comprises Mellor, Coleman Milne, VCS Ambulance, VCS Police, Treka Bus, Binz International and Promech Technologies Press Contact: Paul O'Malley, Torque Agency Group [email protected], +44 (0)7860 649658

0 Comments

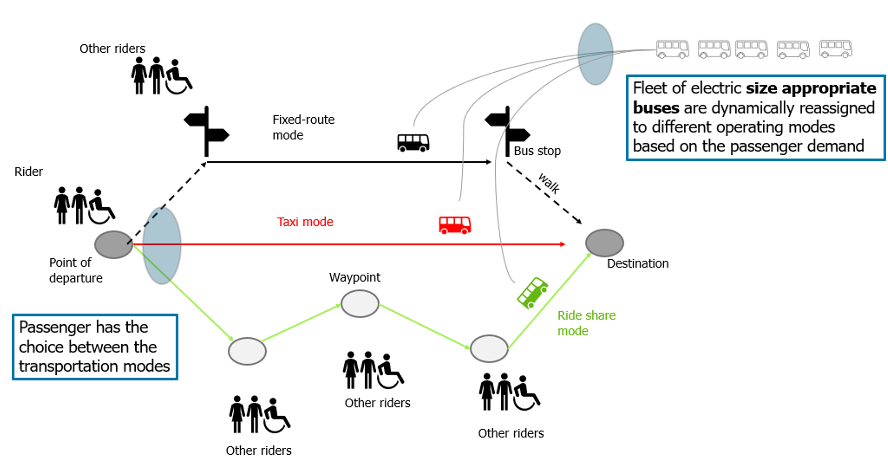

I have just listened to the podcast 'Lunch with Leon', (Leon Daniels and Paul Saint House from Dawson Rentals). I really like these short interviews; in this case we hear insightful views of two of the UK's most experienced logistics specialists. I agree with many of Leon and Pauls observations, especially views on the collateral damage caused to public transport by the war against Covid-19 (C-19). I am not experienced in transport logistics and have never been an operator, but in specialist vehicle 'product' and 'market' development. However, their opinions resonate with my own understanding of what's happened, happening, and is likely to happen in the future. The idea that this virus will compress the time afforded to some current but outmoded transport systems is well observed. Before C-19, the survival battle for buses was already well underway; we live in a time when compared to other road users; traditional bus use continued to fall without any help. Given the likely continued blurring of private-hire vehicles, demand-responsive transport and taxis, we expect a future that combines both the old and new transport options. One such hybrid is Demand Responsive Transportation (DRT) which is currently growing in European cities as shared ride-pooling services. These new on-demand services can support hub-and-spoke services.

C-19 precipitated economic decline seems inevitable; DRT's adaptability might bring other market opportunities, beneficial to cities and metropolitan areas, some research suggests that this is so. In Hamburg where MOIA’s ride-sharing service has been introduced with a specially designed futuristic looking electric vehicle to ensure MOIA’s brand experience during the whole customer journey, passenger numbers and operating vehicles are growing. In Hanover, MOIA’s first operating area, introduced case studies identify leisure trips, as a significant intention for the use of facilities in suburban areas, this behaviour is new, it recognises a younger demographic and increased frequency, different from buses. To quote Leon "The young, and those of you who have teenage children will know this. They leave home with a debit card and a mobile phone – that's their transport, their food, and their drink, and that's what they carry with them. Those people will grow to become the mainstream adults in our society; those will be the mainstream of our economic activity." In the UK, we rusticate DRT's true potential, together with the acceptance of its service requirement. Instead, we rely on carriage systems that are effectively unchanged for over 100 years, but our current circumstances deserve new thinking. "MOIA is a global lighthouse project" it is a Hamburg based shared-ride service ultimately owned by Volkswagen Group, the Berlin-based manufacturer that makes the customised electric vehicles. The company has been successful, partly because of its user experience and partly because of its partnership with Hamburg PTA. It is difficult to say “NO” to a solution that tackles two major societal issues, the right to clean air and economic and social costs of congestion. To make DRT a more natural 'fit' alliances have been formed with the public transit provider and taxi services were appeased with a less aggressive rollout than planned. One important point. Taxi operators in Hamburg (along with colleagues in other European cities Berlin, for example) see PTA's as being complicit in the introduction of disruption. PTA's have learnt from costly engagement exercises with disruptors that have cost a lot and changed little, why is this? If we think about disruptive change has happening because a social 'want' becomes satisfied by emerging technology which combine to create a 'novel' service or product that disrupts incumbent ‘players’ with sunk cost and legacy issues. Like smartphones and hail riding enabled Uber and the elevator enabled the skyscraper. The UK Government is moving swiftly to legitimise e-scooters. Transport Secretary Grant Shapps announced a £2bn fund for green transport to combat overcrowding on public transport amid the coronavirus pandemic. Logistics managers should be disappointed that (unlike the data transparency demanded in the bus bill) we have not requested open data from e-scooter service providers in support of integration. Government actions have circumvented the normal disruptive process by rapidly moving the popular mico-transit system into the mainstream. However, by their efforts, they may marginalise the less ambulatory by reducing the financial potential of another services patronage. Today this may not appear to be a problem, after all the Government is advising us to stay off public transport services. Over 98% of UK buses offer single step and bridged access for passengers, some of which are in wheelchairs. The majority of the single step need comes from people with mobility, breathing and dexterity issues, not forgetting mums with strollers. If we are to have a genuinely integrated working transport system, we must consider it to be for 'everyone'. High floor minibus platforms may appear inclusive because they borrow their look and feel from platform buses, but they are not all-inclusive. Micro-scooters are fun, fast and cheap but they are not for everyone, cycling and walking is better - but not for everyone. Buses are for everyone but are failing because they don't meet the needs of a new travelling public, they are accessible but not accessed. We need a brave Government to evoke change, but it would be a mistake to disrupt the UK transport market by allowing transport brokers and aggregators to enter without a commitment to maintain hard fought social access gains. In exchange for market access, they must recognise societal responsibilities currently delivered by buses. When studied it becomes clear that there is a gap in the vehicle platforms available to adapt to acceptable, accessible transport. OEM's such as VW naturally want to customise a standard van platform because when it comes to manufacturing - more is better! Taking a nudge from Leon and Pauls comments about the integration of dial-a-ride services we should look at minibuses like the Mellor Tucana for inspiration. I have to declare an interest here; I work with Mellor product and market development teams, I have not worked on the M2 classification Tucana, which is a mature product. Mellor build the Tucana minibus using big-bus technology with the user in mind; it has a single step and low flat floor, yet with no little imagination this vehicle could provide all of the experience characteristics associated with products like MOIA with the added benefit of full DDA access. To have real impact we must deliver shared accessible transport in the 'normal driving license' or M1 3.5T space. Only by doing this will be able to blend private hire vehicles with truly shared transport, whether that replacement comes through license restrictions or market forces – it makes sense for this to happen. Importantly, an M1 fully accessible taxi bus is inclusive, and because it is inclusive it should be sponsored by PTA’s that genuinely want to drive change towards a modern flexible share riding service. A few demand responsive buses working without public support is just a business not infrastructure. State-sponsored Disruptive legislation could encourage the replacement of PHV with low floor M1 electric taxi-buses. Data should be shared and open, the employment status of drivers guaranteed and PHV non-compliant licenses constrained. Doing this will radically improve the quality of public transport for everyone. The capital cost of electric taxi-buses will be high; low-floor customisation will be comparatively expensive in the early adopter phases and so; initially, subsidies will be needed- possibly taken from the £2bn green fund mentioned above? When operating costs for small electric buses are analysed, we find that operational running and environmental costs are low. Running an M1 taxi bus should be as viable from a passenger perspective as a PHV, without the added advantage the aggregation opportunities. There is nothing new about taxi-bus, legislation for it exists in the 'act' however, free unencumbered use of the service for first and last-mile needs revision. Because of the UK break from European directives we can also consider a driving license derogation that (subject to approved mass and dimension acceptance) M1 certified accessible taxi-buses could run at 4.2T in line with changes introduced for N1 commercial vans. Additional driver training is accepted; again, this should be in line with the N1 proposed changes. A sad report and yet another example of potential failures in rural community service due to central funding issues.

Over many years we have seen growing Government interest in how to identify quality and measure efficiency using both commercial and CTO operators. The policy has been to focus on modality ’trials’ which continue to fall short in terms of sustainability, partly because the return on investment calculations exclude social value and impact. The integration of disparate agencies is the current prescription to solve our ills. Somewhere in the middle sits a community of individual users who have their own needs and in many cases are; disconnected, lonely and vulnerable. They are unrepresented as a cohort. With society adopting new forms transport service delivery such as Uber, RATP Dev Slide, Arriva Click and Stagecoach little&often perhaps its time to revisit the personal transport plan by considering a social enterprising brokerage approach that could involve 'bundles' of services organised on the behalf? Enterprises with the right social capital could put their stakeholders (the passengers) first, and aggregate opportunities, manage, service provision and unearth innovative solutions drawn from all forms of modality which may also include community-based lift share schemes. This may be an idea worthy of research? ('Buses Bundles and David A. Hensher 2007) We were delighted to be part of a movement to raise money in memory or our wonderful friend Carol who we lost to Adenoid Cystic Carcinoma (ACC) late in 2016. This cancer is relatively unknown. However, like all forms of the disease the impact is devastating. More research needs to be done. Because of the generosity of 60 friends and benefactors the evening raised over £4000 which will be added to money raised by other friends of Carol. The evening started at the Dunham Park Christmas illuminated trail followed by amazing fish and chips and plenty of Christmas cheer at home in Bowdon. A special thanks to Jenny Armstead, The Coachhouse Brewery and Craig at The Fish Bar Crew who helped to make this a special evening and one to be repeated. Revenue retention has become Bus Operators number one priority as passenger numbers in England continue to fall. Have market disruptors changed passenger expectation so significantly that only a major rethink will bring people back to constrained bus services? Steve Reeves gives a personal view of current and changing market challenges .

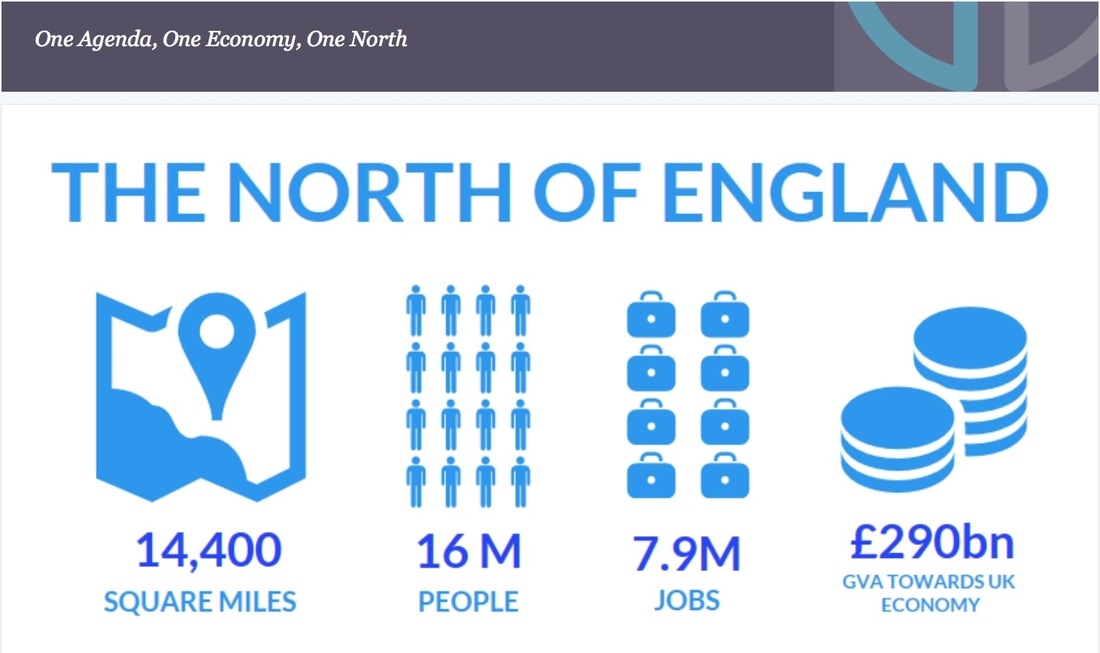

David Begg’s summation at the 2017 UK Bus Summit made an interesting point. Bus Companies do not know their customers! In a battle for passenger retention, this is a significant disadvantage. Capturing passenger data is an element of the smart-ticketing process. Fitting buses with Wi-Fi also supports data collection where free access requires a log-in so, it can be done, but why is it so important? By 2020 68% of adults will be daily users of the mobile internet and 60% of those, will use mobile social networking apps. At the same time; 50 billion 'things' will have connected to the web. Through smart technology our synthesis with products and services is changing elastically- we cannot predict its scale or shape. To mitigate the risk of uncertainty and leverage the opportunity brought by enhanced communication disruptive businesses invest in two things. Firstly, software that integrates third party entities into a single brand combined with payment and customer data platform singularity and secondly; through the provision of excellent and cost-effective user experiences. By publicising the user experience, new customers are tempted to download the App and try the service. A recent PwC passenger trends report states that over half of bus riders surveyed in the 18-35 age group want to see WiFi on buses. A similar US survey found that 97% of passengers who have smartphones, planned to use them on and while waiting for the bus. A word now exists that describes the feeling smartphone users experience when disconnected; that word is nomophobia. Students are found to be most susceptible to this condition; it is no surprise therefore that access to free Wi-Fi is an essential component in many buying decisions. Bus design experts will be challenged to create bus layouts that are attractive homogeneous and relevant to the way in which we behave in this interconnected world. Significant change may not be possible on large transit buses meeting peak hour demands. Smaller Direct Responsive Transport (DRT)' usually associated with dial-a-ride type services, share-ride and rural buses can benefit from more radical changes as they reach for markets needing new mobility solutions. Seating comfort, light pollution management, climate systems (removing fogged-up windows) and a smoother ride come to mind. There is nothing more frustrating (and possibly more dangerous) than using a touch screen while standing on a bus, the balance between seating and standing may need to change. Smartphones integrated with textually rich and compelling new passenger information signage (on the bus and at each stage) may encourage people to use buses. Even without integration smart signage has a positive impact; Experts are pushing for the publication of information related to connecting intermodal services. This is only possible if Bus Companies can work more closely with other forms of transport, this should be encouraged. Mobility as a Service (MaaS) is an idea that extols the end-to-end journey using shared transport systems; to work it requires integration between different modes; this may include share rides and car clubs. Single ticketing helps make MaaS possible; it can also improve the passenger's journey experience. Evidence suggests that the promotion of end-to-end services is the next step for the disruptive business like Uber. The ‘single-ticketing’ of multimodal journeys works for service providers because total control of the supply chain ultimately results in lower fixed costs. Selling prices can be calculated on a 'firm and fixed' or dynamic model particularly when bundles of trips have been purchased wholesale. Service providers with the ability to apply cost pressure on even a single trip component can create lower than current market value solutions where each trip segment is purchased separately. With private hire operators forming the backbone of App-driven transport networks it is not difficult to understand how this can be made to work. This strategy can leverage share riding and even social entrepreneurial services in the push to change mobility into an end to end service controlled by the ticket provider. TfL has already delivered similar services using the Oyster platform; TfGM will sight single ticketing as a primary reason for the introduction of a bus franchising model. The ultimate enemy of the Bus must be the car in whatever form it takes! Figures quoted by TfgM in their future planning literature, state that; half of all trips made are under 2Km and that 38% of those trips or made by car. 50% of all adults do not get the recommended minimum amount of physical activity. When asked why people use their cars for journeys that could otherwise be managed using other forms of transport they give extraneous answers that correlate with their perception of individual status and their need to be in control. “Those with most share least”. Many drivers with a personal car option believe that buses are, for them, the transport system of last resort. People that have no 'better' option use buses, “those with least share most”. These attitudes do not help city planners with congestion, and clean air challenges. How do we change these attitudes? Adobe’s 2017 report into digital trends deals with keeping up with customer expectations; it is an excellent reference piece for company development people trying to draw on current marketing trends to grow their businesses. Adobe has an insight into real world changes; it validates the reports finding through its understanding of how people use Adobe products and services. In their report, Adobe highlights the challenge in keeping up with customer expectations driven in many cases by industry disruptors such as Uber; this is because market disrupters have made their services, simple to use, relevant, flexible and importantly, they provide a level of personal control and choice. Uber has succeeded in changing passenger mindsets by engaging with them through simple to download and use applications. The Adobe report goes on to explain that 23 % of companies surveyed will in now place their greatest effort into selling ‘valuable’ experiences ahead of cost, efficiency and service". Bus Companies are experimenting. Trailblazing services such as Stage Coaches 'Little and Often' and TransDevs Bristol based 'Slide' project have come from bus backgrounds. There are also council services such as Simply Connects new DRT Service experiment in Exeter. Stage Coach is utilising low-floor Mercedes van conversions to provide high-frequency scheduling, almost no need for a timetable, the TransDev project is a Direct Responsive Service (DRT), the 'bus' is a VW T6 minibus. Have these services been delivered with customer experience at the centre of the strategy and if so will that be enough to achieve commercial viability? Or; have the operators created a service model based on the traditional bus values of reliability above experience? Are the vehicles selected going to deliver something people will enjoy? When we look at the evolving changes highlighted above, we might assume that the one size fits all bus model won’t survive in its current format because ‘big-bus’ on its own won’t (can't) meet the ‘control’, and ‘personalisation’ experiences users may be seeking. Those with ‘least’ may want to stick with the bus. Those with ‘more’ may be enticed from their cars, but will it be for the bus? We doubt it! To affect positive market change, Bus Companies need to become increasingly involved in the integrated transport agenda. As trusted public service providers, Bus Operators maintain a unique 'special' status. However, it is the IOT leveraging businesses who are starting to factor intermodal services such as coach and train travel into their selling proposition. Added to this they are also growing incrementally with additional services such as Uber Access and Uber Hop, increasing the level choice feeds the interoperable model because these shifts in service provision help to maintain customer strategic data growth. Today Bus business will continue with the heavy lifting; only they have the resources to provide mass road transit at peak times. During the remainder of the day buses are running under capacity, how long will society accept that large buses are running nearly empty on congested roads? Can bus size appropriation be part of better service provision? Could a new type of vehicle that is smaller, responsive in service delivery, connected and offering car-like interiors be the saviour of shared public transport? This product doesn't currently exist. It needs to be DDA compliant and will cost more than a minivan, however, its conception is not hard to envisage. Smaller custom built DRT buses can challenge bus and journey time reliability prejudices putting slick bus operators in a favourable position from where they can leverage their strength in the battle for customer patronage. Bus Company run, DRT service could be customised to offer personalisation and user control, but they can also be used to feed integrated fixed-route services inside and outside their product offering. It is true that this is not a new idea and that bus company have attempted DRT private hire type services before and fallen short. Today there are key environmental and technological changes affecting the landscape that may make further analysis of the Private Hire DRT and ride sharing idea worthwhile, Uber uses that data to create new services such as integrated single tickets driving targeted multi-modal end to end services. When a market fails - Regulate? Road congestion has aligned the stars for Disruptive Transport and Train companies alike. We stand witness to the increasing number of private hire vehicles carrying single occupants in a variety of vehicles some hardly fit for purpose but all taking the risk for their operators. Taxi companies struggle to compete with the dynamic pricing model, while the bus is losing out because its service (outside of London) appears to become outmoded. When a market fails to the detriment of its societies needs and ambitions, regulation is an accessible alternative. Before this can happen, the choices must be understood. Simply regulating to maintain the status quo doesn’t make sense, we would lose an opportunity for real improvement and a better commuting experience. Is it possible that Bus Companies could underpin an intermodal public transit system? What's needed is a system that provides an open source of ticketing and transport data this way we all share in a multimodal transport network that provides a selection of travel and experience options? Regulation and funding will be needed to deliver fast changes and to encourage service providers to invest in new methods of service provision. If the cost of the driver remains the primary cost of the service then The ‘one size fits all’ solution combined with disruptive competition, public service cuts and congestion is 'doing' for bus services especially outside of London. Only a laggard would hold onto what is failing by relying on regulation for its maintenance. If nothing changes the risk of a future chaotic transport solution growing organically and serviced by those with low rate qualifications will ultimately fall victim to the harsh rules of supply and demand; that collapse will probably come too late for operators that failed to diversify. Read this interesting article about transport spending and where priorities should be placed post Brexit. https://inews.co.uk/essentials/news/uk/londoners-get-1500-transport-northerners/

There is more than One Single Market - One North. Where the service economy is called aftersales..2/13/2017  Today at the UK Bus Summit. Andrew Jones gave the keynote speech. "The buses bill will help operators enter into partnerships to attract customers". The Bill has been sluggish; ambitions remain the same despite concerns from the Lords. Objectives: More passengers, cleaner air, reduced congestion Standards will be agreed locally. Integration of services through mandatory open data planning systems will be delivered Where partnerships don't apply franchises will be available to directly elected Mayors. Other areas can franchise with the permission of the Secretary of State. A consultation has been released and its available on the departments website. |

Steve

|

RSS Feed

RSS Feed